Roi Formula Calculation And Examples Of Return On Investment

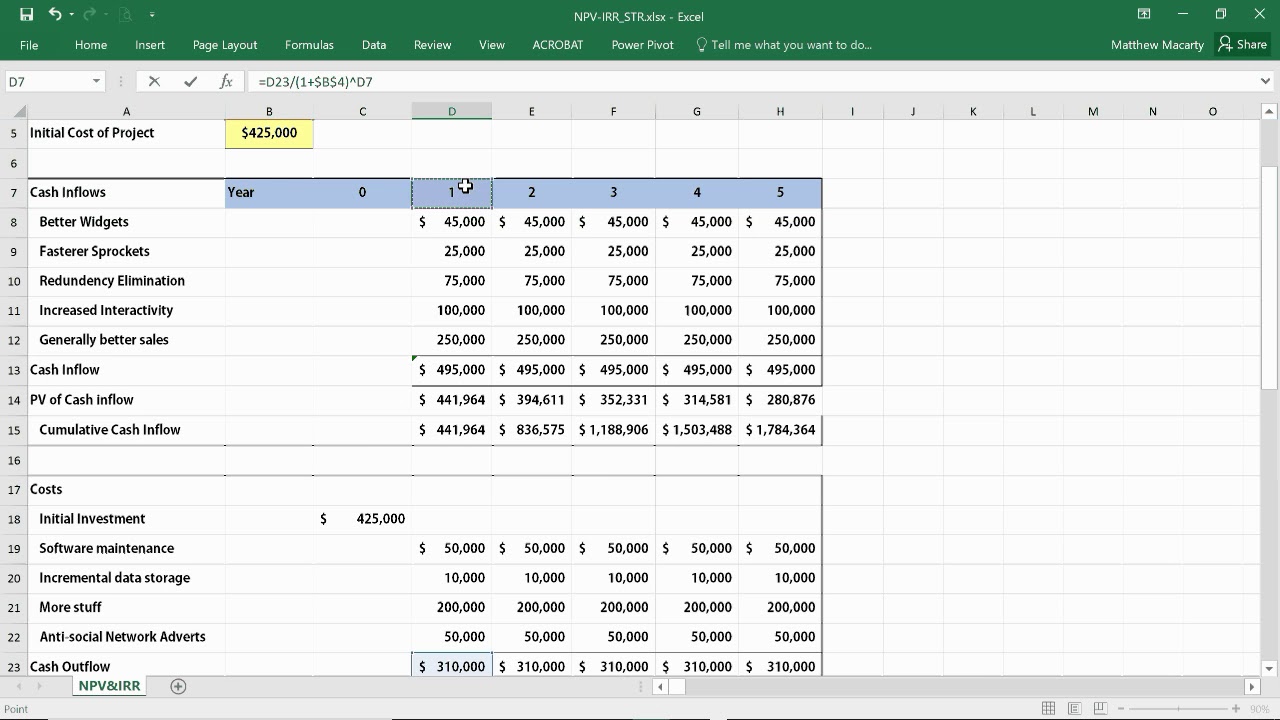

An investor invested $15,000 and sell same after a few years and he sells same at $20,000. then, roi will be as follows 1. return on investmentso from the above calculation of return on investment will be:. An investor buys $10,000 of stocks and sells the shares 1 year later with amount $12,000. the net profit from an investment is $2,000 and roi is as follows:1. return on investmentso from the above calculation of return on investment will be:this is actual profit including taxes and fees. the (return on investment) roi formula can be written as:-“gain from investment” refer to sales of investment interest. return on investment formula is measured as a percentage, it can be easily compared wit Step 4 use roi formula: plugging these numbers into the roi formula, we find that over the next 5 years: simple roi = (savings over 5 years: $500,000 cost of investment over 5 years: $250,000) / (cost of investment over 5 years: $250,000) = 100% over 5 years or 20% per year.

See full list on wallstreetmojo. com. See full list on project-management. info. Return on investment is a key business metric that measures the profitability of then sold those a year later for $12 a piece, you've made $12 for every $10 you you can calculate your own return on investment using the followi.

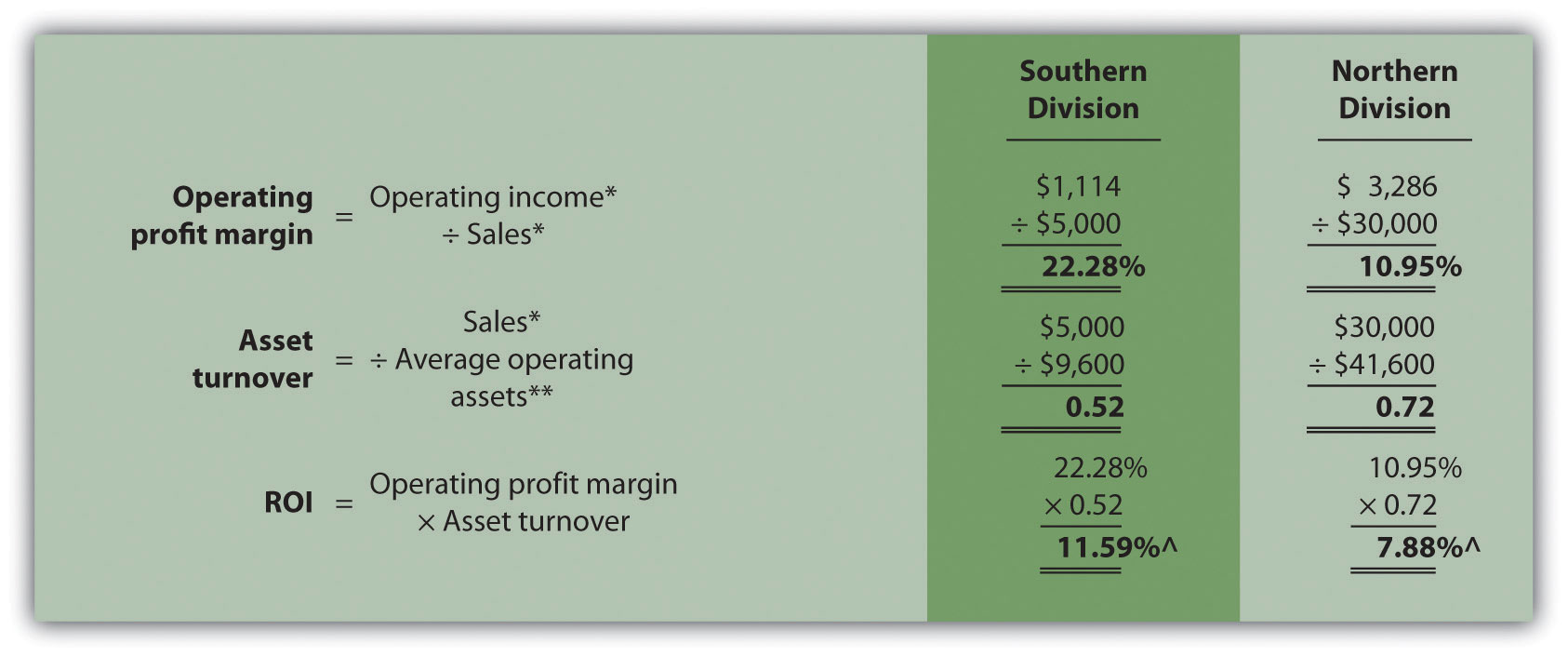

For use in project management, there are various alternatives to an roi. these include payback period, roi formula in years benefit-cost ratio, net present value and internal rate of return. each of these success measures comes with its respective advantages and disadvantages. read our overview of cost-benefit analysismethods to get a full comparison of these approaches:. Return on investment, one of the most used profitability ratios, is a simple formula that measures the gain or loss from an investment relative to the cost of the investment. roi is expressed as a percentage and is commonly used in making financial decisions, comparing companies’ profitability, and comparing the efficiency of different. How is the return on investment calculated for multiplereturn periods?

How Do You Calculate Roi How Do You Calculate Roi

Roi maybe confused with ror, or rate of return. sometime, they can be used interchangeably, but there is a big difference: ror can denote a period of time, often annually, while roi doesn't. the basic formula for roi is:. While the return on investment is a popular and widespread measure, it comes with a number of pros and cons described below. as important as the fundamental advantages and disadvantages of this technique is the way the roi is used in your analysis. mit sloan review points out that the “biggest challenge with roi isn’t a technical deficiency but confusion over how it is used“ (source). The simple annual average roi of 10%–which was obtained by dividing roi by the holding period of five years–is only a rough approximation of annualized roi. Welcome to theanswerhub. com. find roi today!.

Return On Investment Single Multiperiod Roi Formulae

Roi formula = [(ending value / beginning value) ^ (1 / no. of years)] 1you can use the following return on investment formula calculator1. return on investment formula is used in finance by corporates in any form of investment like assets, projects etc. 2. roi formula measure return on investment like return on assets, return on capital etc. 1. simple and easy to understand- roi formula is easy to calculate and it can be calculated by two figures that are benefit and cost. 2. universally Roi formula = (current share price + total dividends received original share price) * 100 /original share price.

Where: roi [multiple roi formula in years periods] = cumulative return over all periods r = return per period [in %] (the equation needs to be solved for r) t = number of periods. the first component of this formula is similar to the future value formula (fv = (1+r)^t) solved for r as the periodic (e. g. annualized) return. This roi calculator (return on investment) calculates an annualized rate of at the top to list the months, then, if needed, click on the year at the top to list years.

For example, suppose jo invested $1,000 in slice pizza corp. in 2017 and sold the shares for a total of $1,200 one year later. to calculate the return on this investment, divide the net profits.

If you were to compare these two investments, you must make sure the time horizon is the same. the multi-year investment must be adjusted to the same time horizon as the one-year investment. to arrive at an average annual return, follow the steps below. changing a multi-year roi into an annualized year formula: where: x = annualized return. The return on investment is an indicator of the profitability of an investment or a project. as the roi is a percentage value, it can be used to compare different projects and investment alternatives with respect to their profitability. the result is a ratio of benefits and roi formula in years returns in relation to investment and costs. this helps compare alternatives with different investment amounts where absolute returns would not be an appropriate measure for comparison purposes.

Fill in the expected returns and the calculated investment. for the assumptions and components that need to be considered, refer to the previous section. the calculator will determine the basic roi which can be used for single-period tenors or investment alternatives with an identical timeline. The basic roi formula. The basic roi formula in its most simple form, the roi is calculated by dividing the returns after cost by the investment: this formula may be applied to single-period projects and investments (e. g. a project delivered within one year, a bond with a 1-year maturity).